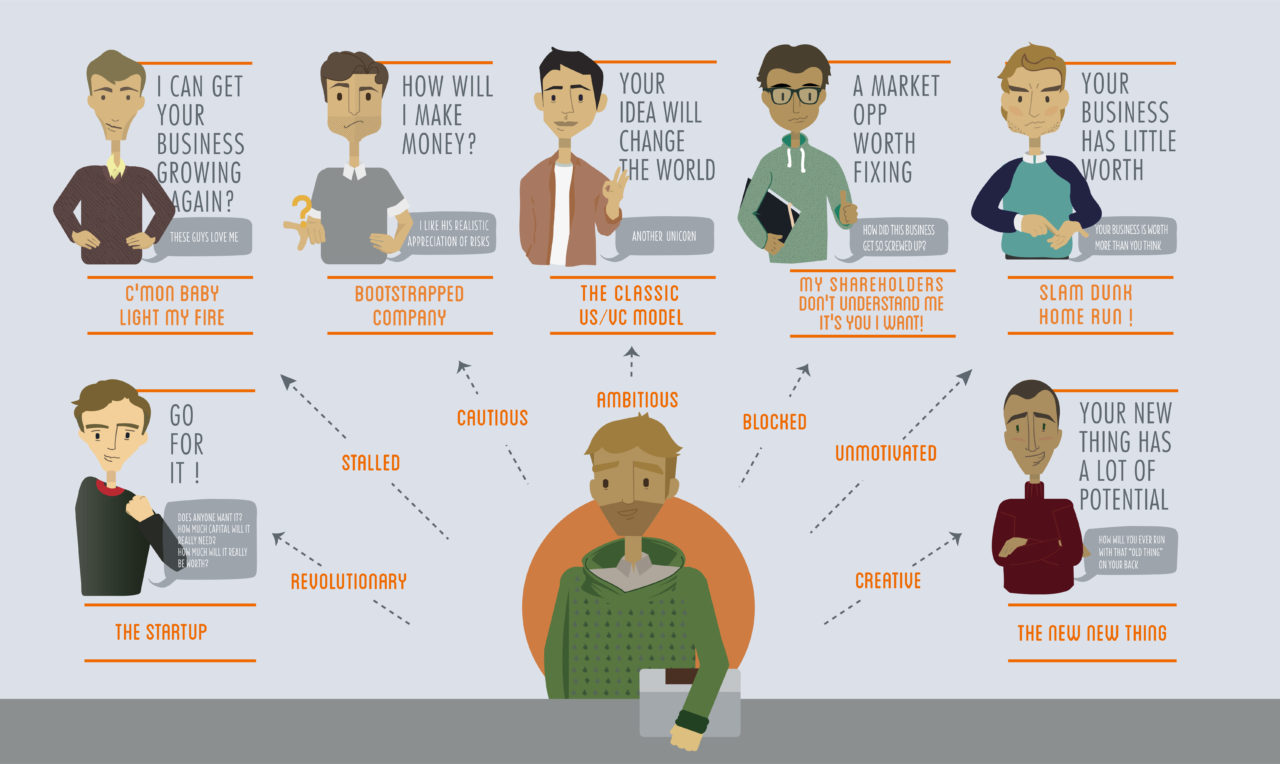

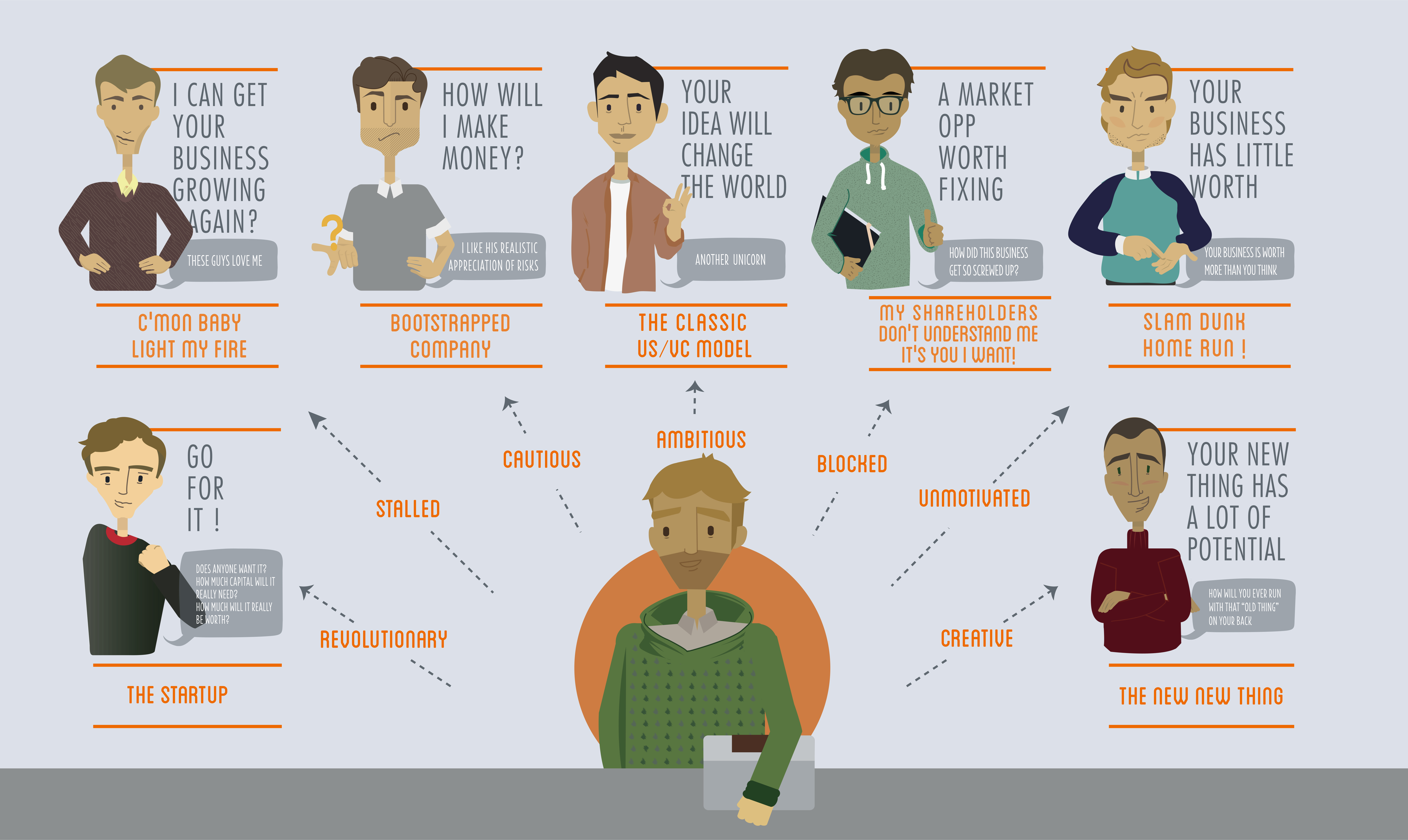

Entrepreneurs & investors might be unaware that during their initial meetings, they are actually telling each other a story, or trope. Over 12 years experience meeting management teams and making investments, has taught me a successful initial meeting depends on whether each partner recognizes, understands and approves of the others’ business trope.

Confused? Don’t be. Over the coming months, our survival guide will look at six of the most recognizable ‘business tropes’. We’ll demonstrate why tropes are crucial in helping you get ahead. You’ll be able to identify which of these entrepreneurial ‘tribes’ you belong to, or don’t, and how each trope is viewed by potential investors.

Recognizing tropes

If you don’t know it, a trope is a device used in literature and media. It provides a pattern that a story follows, like ‘good versus evil’. Tropes automatically generate recognition in audiences, or investors; they think they know how the story goes, and how it ends.

Romeo & Juliet is a famous ‘boy meets girl’ trope, but rather than having a ‘happy ever after’ ending, which we would expect from this trope, it differs. The lovers come from opposing families, resulting in a tragic and unexpected ending. This deviation from the norm captures our attention due to the tension between the trope the story triggers, and the differences to the recognized stereotype.

Similarly, investors are intrigued by businesses whose tropes indicate they ‘should not work’ but still have great financial performance.

Your trope

Importantly for investors, recognizing your story quickly and easily helps them decide if they want to engage with you in a more meaningful way, or not. As you plan ahead for the future of your company, you’ll know issues like raising capital and communicating the equity value of your business should be considered. But, have you thought about what trope you trigger with potential investors and business partners?

In our view, contemplating your trope, identity and message are imperative when building your business. They need to match where you are now and where you want to be. Triggering the right trope helps to ‘tell your tale’ and sell your equity story.

Trope 1: ‘Bootstrapped’ company

The ‘bootstrapped’ company is one you’re probably familiar with but perhaps not as a model investors or business partners are tuned to recognize. Bootstrapped firms start up with little or no external investment or assistance and usually founder/s put in some of their own capital to develop the firm.

Investors expect, as a consequence of the trope, a cautious management team in bootstrapped companies. Any cash expenditure spent on the business could alternatively be paid as a dividend to owners, so founders tend to be very focused on personal financial returns.

Market opportunity

Often there is a less obvious market opportunity with these firms, as they don’t need to build a huge business. They also have small working capital requirements, often funded by friends, family, angel investors and the founders.

If bootstrapped firms do raise capital, it’s often only once to fund international expansion. Exit values are modest at less than €100 million. This type of investment outcome is, obviously, positive for founders, and investors normally gain the returns they expect to make.

A few years ago, I was involved as an investment committee member in a deal where Goviral – an online video distributor – was sold to AOL Europe for just over €70 million. We achieved 4 x return on our initial investment, where our expectation was 3 x return. A great result, but pale in comparison to the business founders who had retained more than majority ownership, resulting in them realizing a significant personal return.

Investors understand the performance of bootstrapped businesses rarely explodes dramatically. Consequently these companies are never ‘super-attractive’ to other buyers as it’s generally very clear what the financial value of the firm is. Buyers are typically grounded and practical about what they are prepared to pay.

On the plus side, bootstrapped firms are rarely written off. Business owners will work very hard to control costs, such as reducing headcount, to avoid running losses.

Steady story

Bootstrapped businesses could be viewed as a ‘steady story’ for investors. As we’ll explore in the coming months, they might not provide the spectacular growth and returns some other tropes offer but they are reliable and sound investments.

If this model reflects your business trope or the one you want to project, you must be practical and cautious about presenting your business plan. It’s imperative any concerns from investors are taken very seriously. Addressing each issue and understanding what any risk mitigation strategy might mean for your firm is essential if you want to be seen as legitimate by prospective partners, as they highlight potential risks to your own wealth.

At Vie Carratt, we offer insight into developing your company. From advice on finding the right financial or business partner, to guidance on and provision of content to support how you ‘sell your story’, we’re here to help. If you’d like to know more, please get in touch.